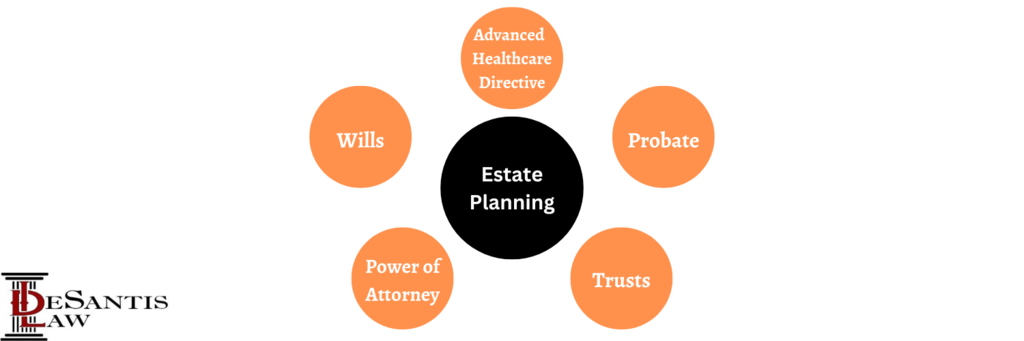

Wills, Trusts & Estates

A testamentary document such as a Will, trust, or codicil, or a power of attorney sets out an individual’s wishes following death or in a situation where that person’s capacity is diminished. Such testamentary documents often do not sufficiently dispose of assets, are ambiguous, unclear, or fail to make adequate provision for a dependent. These situations often become contentious and litigious.

Whether you are looking to minimize taxes upon your death and wish to maximize your estate for your beneficiaries and are concerned that your assets will be diminished through large probate taxes to the government, we can provide information about how to effectively and efficiently manage and transfer assets now and on death. Our lawyers can provide legal assistance to use trusts to preserve wealth. Establishing an inter vivos trust as an alternative to a Last Will, enables assets to be place within the trust vehicle and upon death for its ownership to pass directly to its beneficiaries. Unlike a Will, which merely distributes your assets upon death, a living trust places your assets and property “in trust” which are then managed by a trustee for the benefit of your beneficiaries. Since the property and assets are already distributed to the trust, probate taxes and the delay and expense of probating a Will are avoided. We will work with you to plan and establish a trust that helps you protect your wealth for future generations.

At DeSantis Law we can prepare your Wills, Powers of Attorneys, probate applications, set up trusts, assist estate administrators (executors) realize estate assets, settle estate debts and taxes, prepare estate accounts, fiduciary accounting, and distribute estate assets to beneficiaries.

We can assist individuals who require guidance resolving contentious matters relating to estate administration, Wills, trusts, beneficiary claims, powers of attorney and guardianship, and highlight the legal and tax implications.

Our knowledge of this complex area of the law, our experience avoiding problems and resolving family disputes makes us the firm of choice to help you get the results you want. Whatever the circumstances or the size of the estate, the orderly transfer of wealth and succession planning requires careful planning.

An Estate Plan can:

- Reduce or minimize probate tax, and income tax payable after death

- Ensure that the estate passes in an orderly manner to beneficiaries of your choice

- Ensure that your beneficiary designations are consistent with your plan and your Will

- Ensure that you have legal documents that are consistent with your goals and objectives

- Appoint a person to manage your financial affairs or personal care in the event of incapacity

- Appoint an executor(s) to manage your estate after your death

- Provide for management of property for special needs or minor beneficiaries

- Preserve government benefits for special needs or disabled family members

- Provide family law protection for your beneficiaries

- Minimize disruption to your business and help you plan for business succession

- Provide for the appointment of a guardian for a minor child

We pride ourselves in providing quality service so that your intentions are observed after death to provide you with peace of mind while alive.

At DeSantis Law we are pleased to offer high caliber advice to all our clients in a professional and efficient manner and welcome the opportunity to be of service to you for all your estate and trust planning needs.